Social security windfall elimination calculator

The Windfall Elimination Provision WEP is simply a recalculation of your Social Security benefit if you also have a pension from non-covered work no Social Security taxes paid. The Windfall Elimination Provision WEP affects members who apply for their own not spousal Social Security benefits.

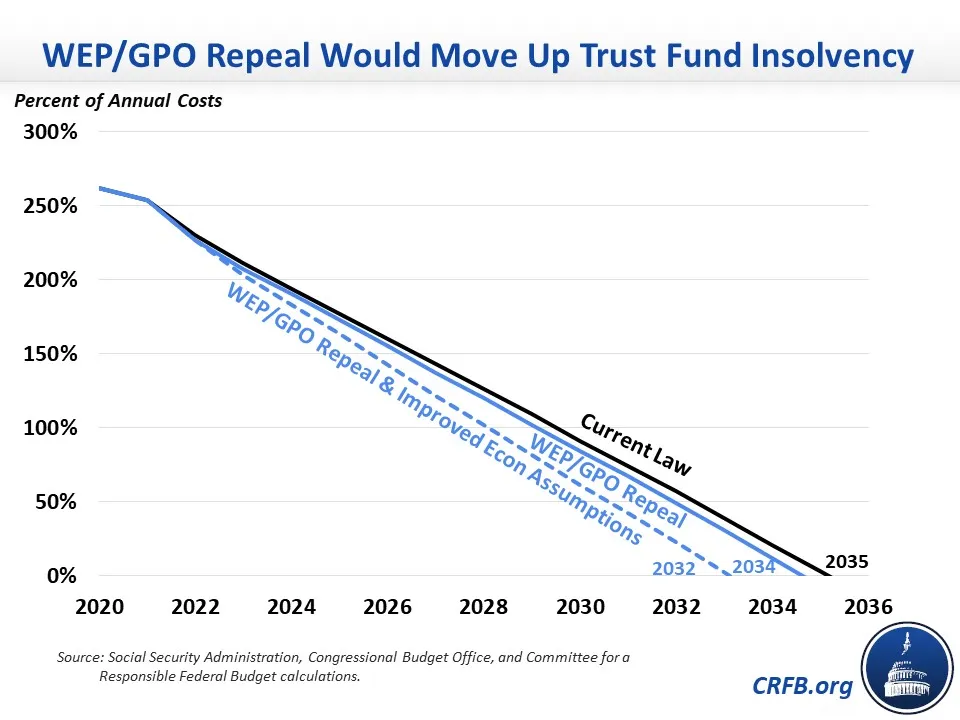

Wep Gpo Repeal Would Mean Earlier Insolvency For Social Security Committee For A Responsible Federal Budget

Refer to the chart below Your full retirement age is 67.

. If your full retirement benefit is 1396 your ELY. 35 rows The monthly retirement benefits are increased or reduced based on your age after WEP reduces your ELY benefit. The Windfall Elimination Provision WEP affects members who apply for their own not spousal Social Security benefits.

I am 62 and. Ad Build Your Future With a Firm that has 85 Years of Investment Experience. They worked at another job where they qualified for Social Security benefits.

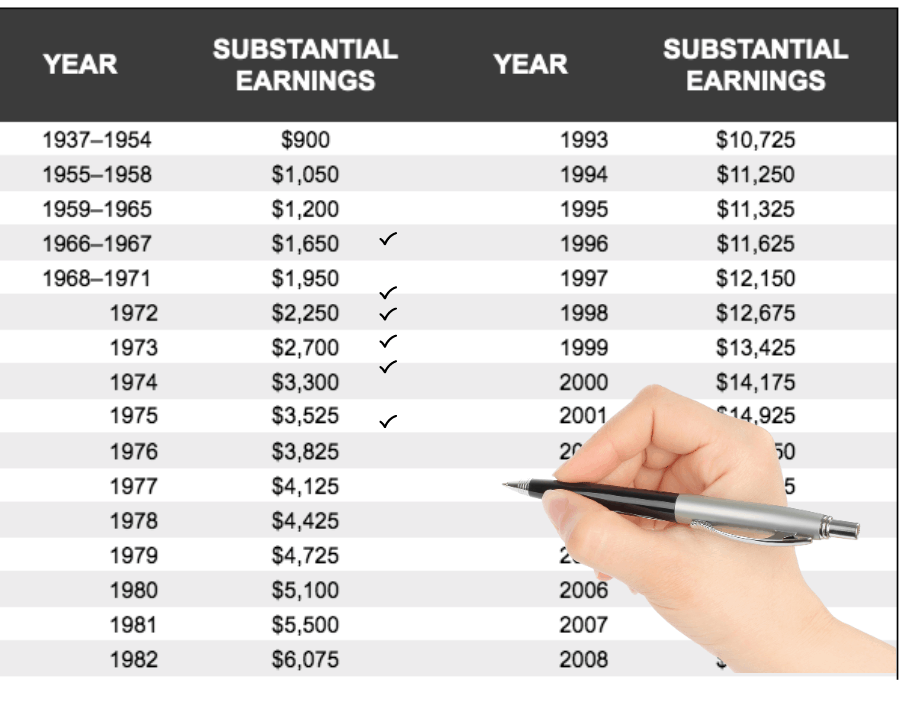

Our Windfall Elimination Provision WEP Online Calculator can tell you how your benefits may be affected. You qualify for Social Security retirement or disability benefits from work in other jobs for which you did pay taxes. How additional years of substantial earnings will affect the WEP penalty.

If you turn 62 in 2022 ELY 2022 and you have 20 years of substantial earnings WEP reduces your monthly benefit by 512. 35 rows The monthly retirement benefits are increased or reduced based on your age after. The amount of Social Security benefit you can expect after the WEP reduction.

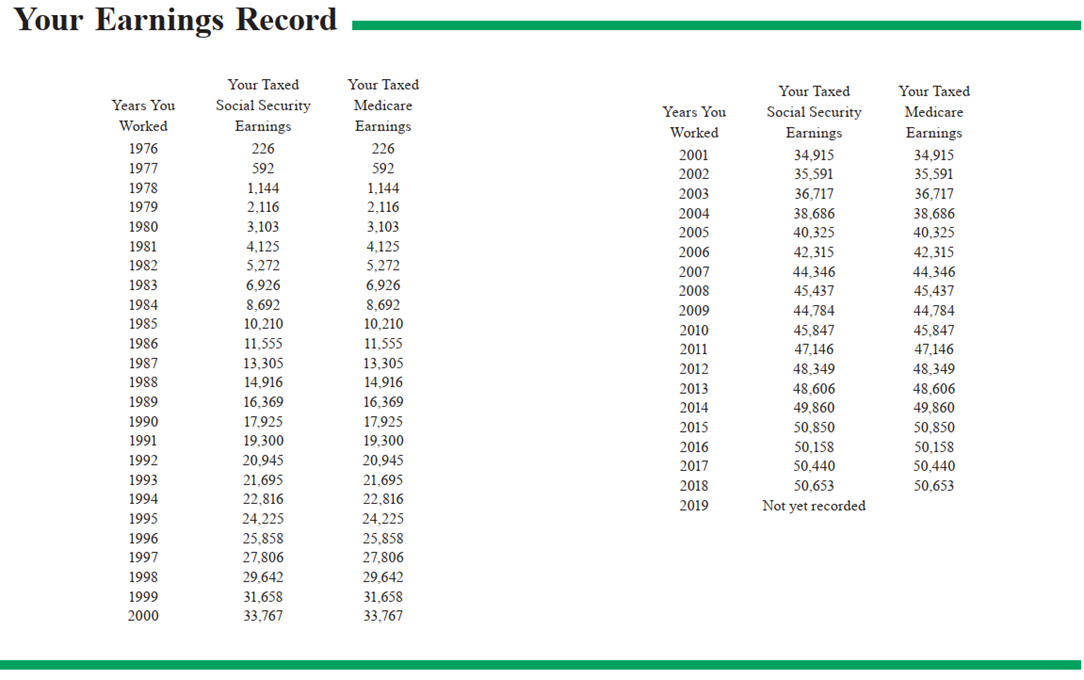

If your full retirement benefit is 1396 your ELY. However that calculator requires you to enter your entire Social Security earnings history. They separate your average earnings into three amounts and multiply the amounts using three factors.

Refer to the chart below Your full retirement age is 67. However that calculator requires you to enter your entire Social Security earnings history. The normal Social Security calculation formula is substituted with a new calculation that results in a lower benefit amount.

The monthly retirement benefits are increased or reduced based on your age after WEP reduces your ELY benefit. The most your Social Security Benefit will be reduced with 20 years of substantial earnings in 2019 is 463. The Windfall Elimination Provision can apply if one of the following is true.

You will need to enter all of your earnings taxed by Social Security which are shown on your online Social Security Statement. Ad Get Your Proof Of Income Letter Online With a Free my Social Security Account. Employer who didnt withhold Social Security taxes.

How to Quickly Calculate Your Penalty sue stecker May 22 2014 at 337 pm. 35 rows Look at our WEP chart below to see how WEP. Its likely that your Social Security benefit will be reduced under the terms of a government rule called the Windfall Elimination Provision WEP.

Tracking down and entering that information may involve significant time costs for some. Teachers are one of the most common groups to be impacted by this rule but it often includes other public sector workers like firefighters police officers and numerous other state county and local employees. If you turn 62 in 2022 ELY 2022 and you have 20 years of substantial earnings WEP reduces your monthly benefit by 512.

Social Security benefits are based on the workers average monthly earnings adjusted for inflation. You also need to enter the monthly amount of your pension that was based on work not covered by Social Security. This is a link to the actual calculator.

However please note that this app will be most accurate for users within 5 - 10 years of retirement. Refer to the chart below Your full retirement age is 67. What the Windfall Elimination Provision Repeal Looks.

For example for a worker who. 2 thoughts on Social Securitys Windfall Elimination Provision. AARP Social Security Calculator.

The monthly retirement benefits are increased or reduced based on your age after WEP reduces your ELY benefit. If your full retirement benefit is 1396 your ELY. Who can use this app.

This calculator will tell you. The number of substantial earnings years you already have. If you turn 62 in 2022 ELY 2022 and you have 20 years of substantial earnings WEP reduces your monthly benefit by 512.

The WEP affects people who receive pensions from jobs in which they were not required to pay Social Security taxes for instance. Anyone who has paid into Social Security at some point in their career can use this app including those affected by the Windfall Elimination Provision. Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators.

The Windfall Elimination Provision WEP is poorly understood and catches a lot of people by surprise. You reached age 62 after 1985. You developed a qualifying disability after 1985.

If you do not have 30 years of Social Security covered work a Social Security WEP Calculator can assist you to calculate the complex formula that will tell you your benefit amount.

/GettyImages-184358375-81456f521f944c6a95f83dd84ce8b06e.jpg)

Social Security Benefits Definition

The Best Explanation Of The Windfall Elimination Provision 2022 Update Social Security Intelligence

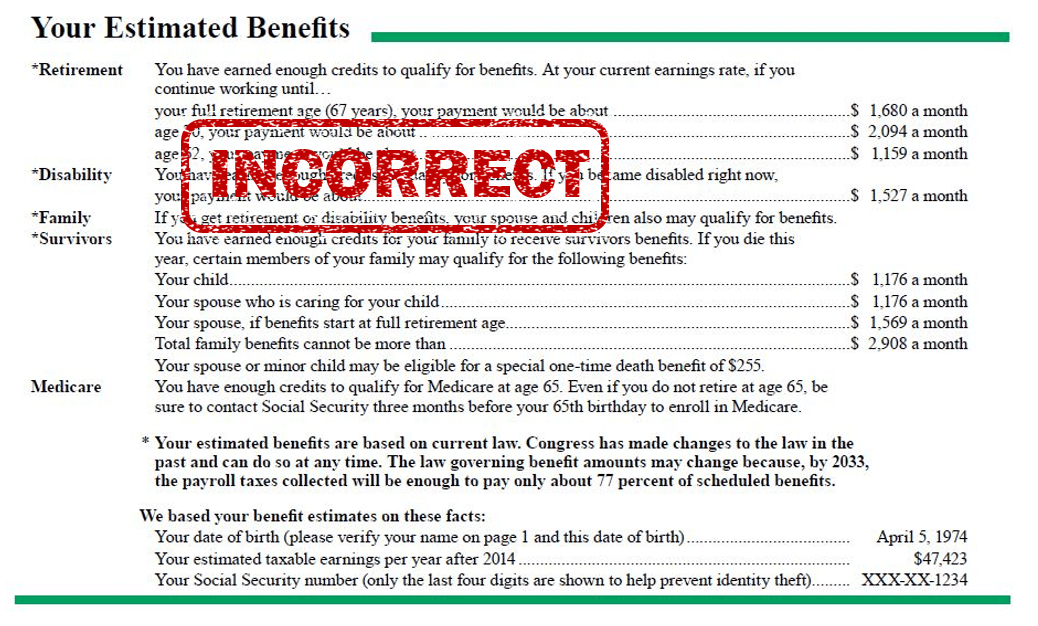

Subject To The Wep Your Social Security Statement Is Probably Wrong Social Security Intelligence

Social Security Wep Fomo Idk Or Lol Retirement Insight And Trends

Wep Gpo Repeal Would Mean Earlier Insolvency For Social Security Committee For A Responsible Federal Budget

If The Windfall Elimination Provision Reduces Your Social Security You May Be In Luck

Calculating Regulatory Aum Vs Assets Under Advisement Aua Regulatory Asset Management

How Social Security Retirement Benefits Are Calculated 3 Easy Steps Youtube

How Does Government Pension Offset Work Smartasset

Us Social Security Benefits For Canadians Le Calcul Riche

/dotdash_Final_How_Are_Spousal_Benefits_Calculated_for_Social_Security_May_2020-01-29ec05cc8e7241ec95054d75a3d998aa.jpg)

How To Maximize Social Security Spousal Benefits

Tips For Selecting Medicare Social Security Aginginplace Org

Social Security Funds Could Run Dry By 2035 Here S How To Prepare

Cpp U S Social Security And Wep

Social Security S Windfall Elimination Provision

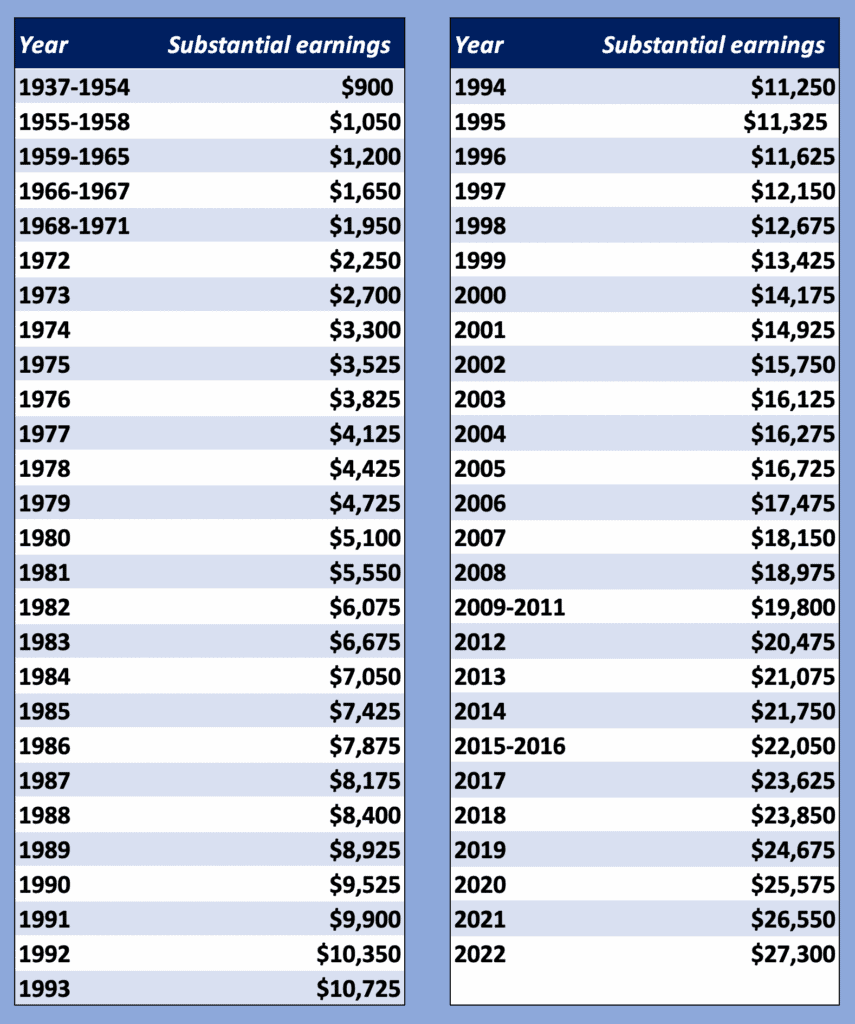

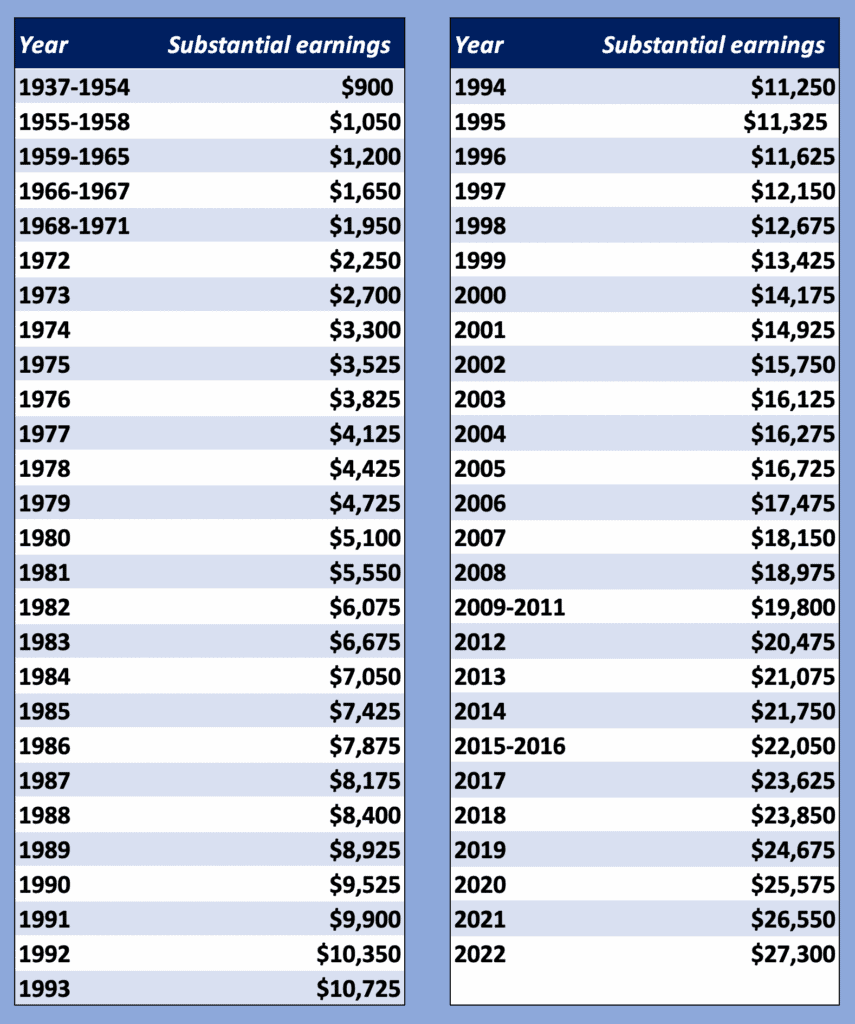

Substantial Earnings For Social Security S Windfall Elimination Provision Social Security Intelligence

What Is The 16 728 Social Security Bonus Secret